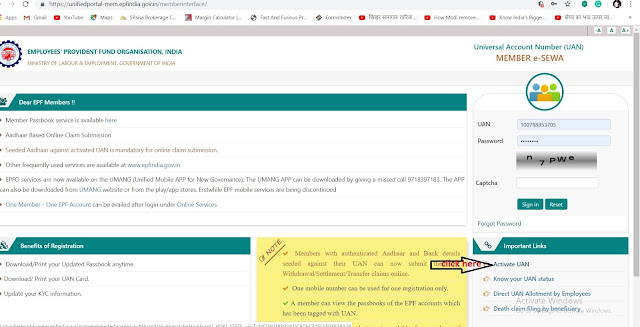

How to activate UAN number in PF account very simple and easy way?

Employee provident fund organization: Activation of universal account number (UAN) is very important for the account holder. If you have done this, then you will be able to get any information related to your account directly from your home. Employee provident fund organization provides a wide range of facilities to its members. EPF account holders can also do online monitoring of their accounts. For example, the account holder EPS includes nomination and online claim files. Apart from this account holders can also access the EPF passbook . Universal identification number is an important number to get information related to your EPF accounts. Every company makes EPF member ID for its employee, which changes when job changes. For example, if you join a new job, then you will be given a new EPF account by the company. It is in this account that money is deposited. Today we are giving you information about activating the universal identification number in your EPF accoun